Social Security COLA for 2025

The Social Security Administration has announced an 2.5% benefit increase for 2025, based upon inflation for the twelve months ending September 30, 2024. As inflation has subsided, so has the rate of benefit increases—the COLA was 3.2% for 2024. For the average retiree, the increase will come to about $50 per month.

With the increase in average wages comes an increase in the wage base for those who are still working. It goes from $168,600 in 2024 to $176,100 in 2025.

Roughly 68 million Social Security beneficiaries will receive the increased benefit. The Social Security Administration did not project the total value of the COLA expense for 2025. A rough calculation would be $40.8 billion (68 million recipients x $50/month x 12 months). The increased expense will be offset by the additional 15.3% in Social Security taxes (employee plus employer share) on the $7,500 increase in the wage base (that comes to $1,147.50 in tax revenue per affected taxpayer).

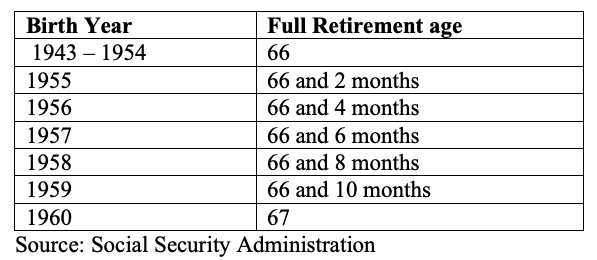

Everyone has the right to claim a reduced retirement benefit at age 62, while the date for claiming full benefits varies with the year of birth. Full retirement age was originally age 65, but has been slowly raised over the years.

The table below shows how the higher ages are phased in.

Social Security benefits are intended for those who are retired. Those who keep working after beginning their benefits face the possibility of benefit reductions. One dollar of benefits will be withheld for every $2 of earned income above $1,950 per month ($23,400 per year). Note that this penalty only applies to earned income; dividends, interest income, and capital gains are not taken into account. A much higher limit applies in the year in which the retiree achieves full retirement age. In the case the exemption comes to $62,160 for the year, and one dollar of benefit is withheld for every $3 over the limit.

Those who have a “my Social Security account” with the Social Security Administration may view their specific COLA increase online. Otherwise, everyone will receive a notice by mail of the projected change to their Social Security benefits for 2025.

(November 2024)

© 2024 M.A. Co. All rights reserved.

Some information provided in the Knowledge Center may be obtained from outside sources believed to be reliable, but no representation is made as to its accuracy or completeness. This information is intended for discussion purposes only and should not be considered a recommendation. The information contained herein does not constitute legal, tax or investment advice by Country Club Trust Company. For legal, tax or investment advice, the services of a competent professional person or professional organization should be sought. Trust services and investments are not FDIC insured, are not guaranteed by the Trust Company or any Trust Company affiliate, and may lose value. Past performance is no guarantee of future results.