The Bottom Line - Banking on Community Stewardship

Banking On Community Stewardship

How community relationships inform and inspire attentive asset management for local nonprofits and institutions

Managing a local institution's endowment and financial assets is a special privilege for us. We are humbled by the solemn responsibility to preserve and help grow these precious assets, and we’re also filled with the pride of working with some of the area’s most beloved institutions.

We additionally can’t help but feel that our local ties provide some unique advantages to these institutions and their local benefactors. Our financial approach, for example, is balanced and informed by a deep understanding of our community’s needs and values. Our local relationships are often built on personal connections that go far beyond standard business dealings, creating a unique alliance that benefits the institution and the area.

Our community and its institutions are at the forefront of all our decisions because we are immersed and surrounded by them. Unlike national or global financial institutions that may see local institutions as names and account numbers, we see them as cultural landmarks, educational pillars, and community treasures that also happen to be in the cities and neighborhoods we all live in.

This means we have a vested interest in seeing them thrive, because we don’t just manage their assets. We attend their performances, celebrate their graduations, lend a hand through volunteerism, and understand these organizations' cultural – and community – significance.

Yes, we must be good at managing an endowment responsibly with stocks, bonds, and investment returns, but it goes beyond that for us. It’s about fostering long-term relationships with institutions, understanding their unique needs, and aligning investment strategies with their values. We maintain close, ongoing communications with the institutional leaders and constituencies they serve.

Through proximity and active support of community events and activities, we foster a sense of dedication among our investment professionals rather than mere obligation. We don’t simply support local institutions because a client requires it but because we care deeply about their success, look forward to participating, and because we enjoy it.

We also strive to listen and observe carefully. We understand that each institution has its own priorities and investment philosophy. Whether it’s a focus on education, the arts, or other types of charitable causes, we focus on the documentation of these priorities in detailed investment policy statements. These statements guide the financial strategy and reflect the institution’s mission and values. We believe it’s crucial to help organizations in ways that align their financial goals with the broader impact they aim to have in the community.

Our flexibility and responsiveness are also critical advantages, enabling us to offer personalized strategies that larger national firms may struggle to provide.

Community involvement and investment experience are at the heart of our approach to endowment management, and we believe it’s a crucial formula for success. It’s our honor to serve, our privilege to protect, and our joy to support several of the best and most beloved institutional endowments in our area through time, talent, and treasure.

We invite you to see what we mean and experience the difference that local, committed investment professionals can make in the preservation, security, and future of the local organizations and institutions we cherish the most.

— Chuck Maggiorotto, CFA, CFP®, Chief Wealth Officer, Country Club Trust Company

Country Club Trust Company (CCTC) is a division of Country Club Bank. Trust and Investment Services:

• Are not insured by the FDIC or any other federal government agency

• Are not deposits of, nor guaranteed by Country Club Bank, Country Club Trust Company or any of its affiliates.

• May lose value.

Economic Insights

With inflation near target, the Fed cuts interest rates and shares its positive outlook on other indicators

At the most recent Federal Open Market Committee meeting on September 18, 2024, The Federal Reserve decided to lower interest rates by 50 basis points to a target range of 4.75% to 5.0%, marking its first rate cut in four years.

This policy shift reflects the Fed’s view that the softening labor market now poses a greater risk than inflation, prompting a new stance to head off a sharp slowdown in employment.

The Fed also reiterated its commitment to achieving maximum employment and maintaining inflation at its long-term goal of 2%. While inflation moderated again in August to 2.5%—closer to the Fed’s target—the labor market has shown more signs of slowing. The Committee revised its description of job gains from “moderating” to “slowing”, further signaling the Fed’s shift in focus from controlling inflation to stabilizing employment.

The Fed’s Summary of Economic Projections shows more positivity in general among members. Most telling, they anticipate further rate cuts soon, with an additional 50 basis points of cuts by the end of 2024, followed by 100 basis points of cuts in 2025 and 50 more basis points in 2026, with rates expected to stabilize around 2.9% by 2027.

The Fed doesn’t expect the unemployment numbers to improve until they get slightly worse as they are projected to increase, with the median forecast for 2024 rising to 4.4% from the current 4.2%. This modest uptick is seen as a necessary adjustment as the economy continues to respond to tighter monetary conditions that won’t be alleviated entirely by the latest interest rate cut.

Fed Chair Jerome Powell emphasized the central bank’s focus on supporting maximum employment as inflation moves closer to the 2% target. Powell noted that while inflation remains a priority, the labor market’s rapid cooling has shifted the Fed’s attention toward preventing a more severe slowdown.

In other good news, projections on GDP remained steady and positive, with estimates ranging from 1.8% to 2.6% for the remainder of 2024.

Bottom Line: The impact of tighter monetary policy seemed clear, and officials felt compelled to ease, but the results are far from certain at this point. While layoffs remain low, the pace of hiring has slowed considerably. The ratio of job vacancies to unemployed workers has dropped to under 1.1, down from 1.25 pre-pandemic and a high of 2.0 when the Fed began raising rates in March 2022. Further deterioration could cause widespread unemployment jumps, but this cut should help protect against that.

Also, sectors sensitive to interest rates, such as manufacturing and real estate, have shown weakness and could benefit from easing as well. Meanwhile, more corporations report that low and middle-income consumers are pushing back against rising prices, forcing companies to offer more discounts and promotions. The fundamentals still appear solid, but concerns remain, and the timing of the Fed’s rate cut has been well received by markets.

— Marcus Scott, CFA, CFP®, Chief Investment Officer (CIO) for Country Club Trust Company

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

The opinions and views expressed herein are those of the author and do not necessarily reflect those of Country Club Trust Company, a division of Country Club Bank, or any affiliate thereof. Information provided is for illustrative and discussion purposes only; should not be considered a recommendation; and is subject to change. Some information provided above may be obtained from outside sources believed to be reliable, but no representation is made as to its accuracy or completeness. Please note that investments involve risk, and that past performance does not guarantee future results.

Client Success Story

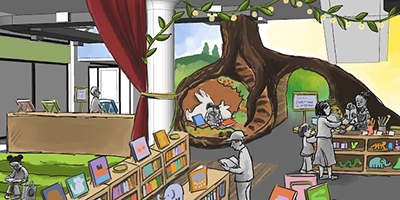

The Rabbit Hole brings children’s literature to life with future-focused financing from Country Club Bank

Designing and building an immersive children's literature museum like The Rabbit Hole – especially one of the first of its kind – is a massive and multifaceted undertaking requiring vision, financial acumen, and community engagement.

Designing and building an immersive children's literature museum like The Rabbit Hole – especially one of the first of its kind – is a massive and multifaceted undertaking requiring vision, financial acumen, and community engagement.

Like writing a book, it can take a while to get started, but the story can unfold quickly when you have a vision that resonates and community partners willing to listen, imagine, and invest.

Pete Cowdin and his wife, Deb Pettid, have been living this story for the past eight years as they’ve worked to bring The Rabbit Hole to life. Cowdin, a gifted storyteller himself, simplifies the origin story for brevity and clarity:

“We had a children’s bookstore for a long time (The Reading Reptile for nearly 30 years), we loved it, but we also thought a lot about how we could engage kids with books outside of the retail space, and that was the beginning of our concept for The Rabbit Hole.”

Cowdin and Pettid were also motivated to preserve the historical significance and rich culture of older children’s literature lost and forgotten in the modern publishing business model.

“For publishers, it's all about new books and top-sellers now, and people don’t even get to see most of the great literature for kids because they don’t promote their backlists,” said Cowdin.

Open since March 2024, The Rabbit Hole is enjoying rave reviews, national press coverage, and attendance figures well ahead of projections. While Cowdin knew they had a vision for something special, it wasn’t always clear how it would happen until a few key supporters emerged.

“The connections we made through the bookstore over the years helped a lot, including our connection with John and Marnie Sherman, whose kids grew up in our store,” said Cowdin. “The Shermans understood what we were doing and wanted to help immediately.”

Best known as the majority owners of the Kansas City Royals, the Shermans contributed strategic ideas and connections in addition to an initial investment to fund development. Other board members signed on, and the next big step was to choose a building to house the new museum.

Around the same time, Cowdin connected with Joe Close, President of Country Club Bank.

“We knocked on about 12 or 15 doors with little success, and then we met Joe Close,” Cowdin said. “He got what we wanted to do, took it back to Country Club, and they provided the loan to buy the building we’re in today.”

Cowdin said the Bank signed on as a partner because it could see more than a real estate loan.

“They saw that there was nothing quite like it in Kansas City or anywhere for that matter, and it was filling a gap and could be something special for the Kansas City area,” Cowdin said. “Their understanding of the community and the market enabled them to imagine the possibilities and make the only fair loan offer we received.”

Cowdin said attendance and revenues at The Rabbit Hole are well ahead of schedule, with over 150,000 visitors expected to pass through the museum in its first year. Plans have also already begun for new and rotating exhibits to keep visitors coming back regularly. Cowdin is equally gratified and amazed by the journey.

“The Bank was fundamental to our ability to move the project forward, and it was kind of miraculous thinking about this,” said Cowdin. “You just get lucky sometimes, and we were lucky enough to find Country Club Bank.”

Endowment Fund Success Story

Starlight Theatre's future shines bright with Uniquely KC capital campaign and endowment management by Country Club Trust Company

For nearly 75 years, Starlight Theatre has been a favorite Kansas City destination for live theatre, concerts, and community experiences, presenting an average of 100 events and hosting approximately 320,000 guests from across all 50 states each year.

President and CEO Lindsey Rood-Clifford, a Kansas City native who grew up attending shows at Starlight and performing in local theatre, now uses her experience in arts administration and philanthropy to manage the organization's $20 million.

“One thing that’s been important to us is having community partners that care about the work that we're doing and want to come alongside us and help,” Rood-Clifford said. “Country Club Trust not only manages our investment portfolio, but it is bigger than that; they’re a great local partner supporting a local institution, and that makes a lot of sense for us.”

Rood-Clifford said the immediate benefits of having local partners like Country Club Trust are accessibility and responsiveness.

“We meet in person to talk about dollars and cents, but we also talk about upcoming events, programs, and shows because many of the Bank’s executives are past board members, season ticket holders, and arts supporters who know how important Starlight is to the community,” said Rood-Clifford.

With endowment investment decisions handled by Country Club Trust, Starlight executives and board members can focus more on its mission: making theatre and live music accessible to all.

To support and grow this mission, Starlight is currently in the middle of its $40 million "Uniquely KC" capital campaign. The campaign, which has already raised nearly $24 million, is designed to modernize the venue and expand programming.

Plans include the construction of a canopy to cover almost half of the 8,000-seat theatre, renovations to enhance accessibility, and the creation of new educational programs for children and young adults.

Groundbreaking for these new construction improvements is scheduled for Fall 2024.

Country Club Trust Company (CCTC) is a division of Country Club Bank. Trust and Investment Services:

• Are not insured by the FDIC or any other federal government agency

• Are not deposits of, nor guaranteed by Country Club Bank, Country Club Trust Company or any of its affiliates.

• May lose value.

Banking on KC Podcast

Tune In: Matt Anthony of Head for the Cure Foundation: Defeating Cancer Step by Step

Tune in to the latest Banking on KC podcast episode, where Kelly Scanlon talks with Matt Anthony, Chairman Emeritus of VML and Co-Founder of Head for the Cure. This Kansas City-based foundation inspires hope for brain cancer patients, their families, friends, caregivers, and other supporters while celebrating their courage, spirit, and energy.

Learn how Anthony has focused his entrepreneurial energy and passion toward building awareness, raising funds, and igniting hope for those who have faced brain cancers that are not widely known and need advancements in treatments to help patients. Listen to the full episode here.