Move from Fraud Detection to Fraud Prevention

Payment fraud attacks are on the rise and can be costly. They disrupt business operations, including payment systems, and impact corporate reputations. At Country Club Bank, our goal is to let you take care of business by letting us take care of your business banking needs. We consider financial education and fraud prevention awareness a critical part of those needs. As cyber threats continue to grow, it is imperative that your business develops resiliency strategies to mitigate this risk and lessen the impact of potential attacks.

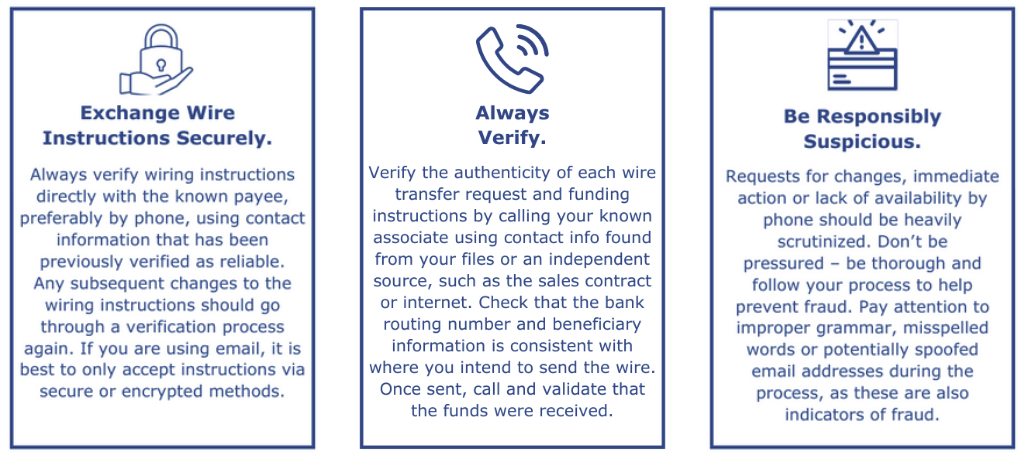

If your company utilizes wire transfers, we recommend company-wide policies designed to increase employee awareness about wire transfer fraud that incorporate some or all of the following preventative actions.

3 Key Actions for Wire Fraud Prevention

Country Club Bank's Business Online Banking is a dynamic tool where your corporate computer becomes your very own Country Club Bank financial center. This tool provides several features and benefits that help mitigate payment fraud, such as:

-

Secure login and authentication controls

-

User permissions & controls: establish dual control transaction processing

-

Wire templates for repetitive transactions: these help reduce errors & provide efficiency, as well as track previously provided instructions

-

Transaction status monitoring & history

Contact us today for more information or to discuss other fraud prevention tools your business may benefit from.

The information provided is intended to help clients protect themselves from wire fraud. It does not provide a comprehensive list of wire fraud activities or best practices. Your organization is responsible for determining how to best protect yourself against wire fraud and for selecting the best practices that are most appropriate to your organization's needs.

* 2023 Association for Financial Professionals – Payments Fraud and Control Report