ALM Basics: Income Simulation

**Note: This post is part of a series on the basics of asset liability management.

As discussed in an earlier "ALM Basics" post, community financial institutions have two primary methods for measuring interest rate risk; income simulation and market value of equity. As stated in that post,

For short term interest rate risk, banks perform an income simulation. In this simulation, banks make assumptions about how loans and deposits will reprice in a given interest rate environment, and how optionality in the balance sheet (like prepayments and calls) will be exercised. With these assumptions, banks then model what each part of the balance sheet will do in a series of interest rate environments and what the impact will be on net interest income, thereby determining what rate environments represent an exposure to earnings.

In practice, the complexity and sophistication of this process is dependent on the complexity and sophistication of the bank being modeled. However, there are some basic tenets to this process, and all banks generally follow the same basic procedures (generally defined by the regulatory guidance):

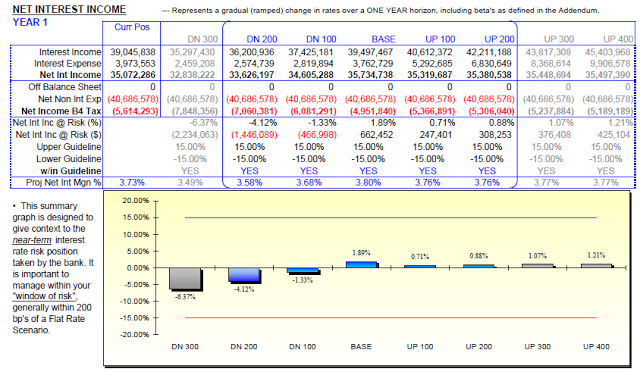

- Risk Tolerance Defined: This task is generally handled by the Asset Liability Committee (ALCO), but must always involve the directors of an institution. The directors and management must determine what level of volatility in earnings is acceptable. As with all risk decisions in finance, the willingness to accept higher volatility will result in a higher potential upside that must be weighed against the potential downside. For income simulation, the bank compares the income level in various rate scenarios compared to the income at a base (or current) level. The risk is defined in terms of a percentage of net interest income, and risk tolerance will be commensurate with capital levels and the amount of risk in other parts of the business. While each institution must determine their own unique risk tolerance, the industry standard for interest income at risk has typically been 15% or less (more to come later on how to set risk tolerance levels).

- Data Collected: In order to properly model results, the bank must collect data that will show the structure and terms of all balance sheet components, including investments, loans, deposits, and borrowings. While this is sometimes aggregate data based on broad categories (i.e. from call report filings), the trend has been for more banks to use instrument level data in order to accurately model results (click here for more on this issue). The data will include structure and term information such as repricing date, index, margins, repricing frequency, floors, ceilings, etc.

- Assumptions Created: As with any forecast, an income simulation will require a series of assumptions to be made about future events. In an income simulation, the major assumptions include deposit pricing betas, loan pricing betas, and prepayment speeds on loans and investments. We recently wrote a white paper that was published by the Financial Managers Society that details the process more thoroughly. Also, a shorter explanation of the assumptions process is available here.

- Model is Run: Once the data is collected and the assumptions have been built, the model can be run to forecast income in different rate scenarios. The guidance suggests that simulations be run for at least 24 months into the future, and that a wide range of rate scenarios be tested. The scenarios generally include rates moving up and down by 400 basis points, as well as non-parallel shifts like a steepening or flattening yield curve.

- Results Compared to Policy Limits: After the model has been run, the results can be compared to the tolerance levels established by the directors. The reports often look something like this:

- Results Back Tested: In order to ensure that a model is generating reliable results, it must be periodically back tested. This is usually done quarterly, but should happen annually at the very least. Back tests are done by comparing what the model forecasted would happen to what actually happened. In this way a model's accuracy can be tested after allowing for variances due to balance changes. Back tests generally look something like this:

- Model Audited or Validated: In addition to back testing, banks also are expected to periodically have their models independently validated or audited. This will ensure that the results are reasonable, and that the assumptions being used in the model are a reasonable proxy for true balance sheet behavior.

As with nearly all parts of the ALM process, an income simulation can either be done by a bank in house or it can be outsourced to a third party. The procedures are nearly identical, with the exception that outsourced providers collect the data, and then deliver the finished reports. While the bank is still responsible for understanding and managing the modeling process, it is physically done by the provider. Banks handling the process in house usually purchase software that handles the modeling, and are then responsible for all input and modeling, including tracking and managing access and changes to the model itself. Both methods are acceptable to regulators, as long as the process is clean and well documented, and all new guidance is incorporated as necessary.