Marginal Profit Analysis of a Loan

We would like to relay an interesting conversation we had with a banker from late July. The discussion was on loan demand as it continues to be a hot topic among most community bankers. This banker indicated that he was deciding between two new loan deals that came across his desk recently.

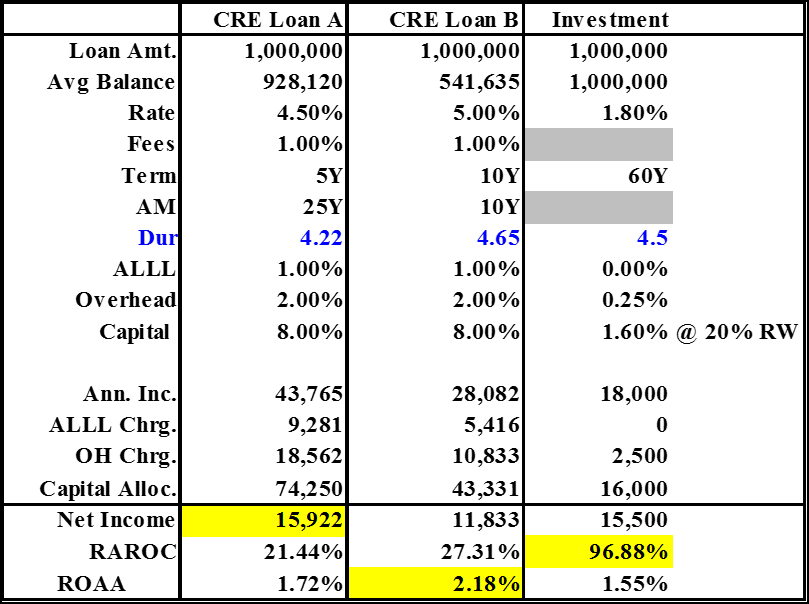

The first loan was a 5 year CRE on a 25 year amortization at 4.50%, and the second loan was a more competitive 10 year CRE loan on a 10 year amortization he believed would could get done at 5.00%. He was concerned about the interest rate risk on the second deal, although he felt that it was a better overall credit. “What would you do?” he asked.

The question seemed simple enough, but the real question is one of identifying the primary objective. “What do you want most?” we asked him. “Do you want to Maximize Net Income?” “Maximize Return on Average Assets?” “Maximize Return on Equity?” “Minimize Credit Risk?” “Minimize Interest Rate Risk?” His response was, of course, “YES!” Yes to all of those.

You can imagine his confusion when asked, “What about bonds?” “Bonds?” he says, “You must be a heckuva bond salesperson to even suggest those. If I bought bonds, my shareholders would fire me on the spot.” When he finished laughing, we went over the math to see how each of these choices fared. We mentioned a 5 year Agency at a 1.80% yield as a comparable, something we could easily find in today’s market, and one our friend would readily dismiss “out of hand”.

Marginal Profit Analysis is a great way to answer all of these questions, and quickly. Here is what we put together to simplify the analysis:

As you can see, the duration is roughly the same for each alternative, so the net after accounting for funding cost would give us the similar results.

So the answer to our conversation is, “…it depends”.

If your primary interest is in maximizing Income, Loan A appears to be the best choice.

If your primary interest is in maximizing Return on Average Assets, Loan B is likely the best choice.

If your primary interest is in maximizing the Risk Adjusted Return on Equity, a high quality risk weighted Bond is the better choice in this example, by a wide margin.

If your primary interest is in minimizing CREDIT Risk, then Loan B might be your answer (since he indicated it was a better credit to begin with)

If your primary interest is in minimizing Interest Rate Risk, then any of these will do, since they all carry similar cash flow durations.

And surprisingly, the investment alternative is second to Loan A in Net Income, and not a too far distant third in ROAA.

Obviously, this marginal analysis does not necessarily work when extrapolated to the entire balance sheet. That is, our ROAA would not be 1.55% if we had 100% of our assets in bonds, even though in that case we would likely have significantly lower overhead expenses, but probably not 0.25%.

There are generally a couple of objections that typically come up and we want to address those. First, we understand that our primary business, as a bank, is in making loans. That is our reason for existing in most cases, and we believe that loans should always be our first choice, since they maximize both Net Income and ROA. Once we have nearly maximized capacity given our current overhead, the question then becomes one of “marginal profitability”. This is when we have reached a threshold that the Risk Adjusted Return on Equity should take over as the primary objective. Our capital is more valuable at that point, and ROA should be a secondary consideration. This also helps to address the second objection we will typically encounter, which is that we already have invested in the overhead. We typically aren’t going to shut down our loan platform, or reduce loan staff, or reduce our processing charges, so, the argument goes, if we have this overhead, then we should maximize the return given that overhead.

We can agree on this as well, up to a point. The laws of diminishing returns takes over at some stage, and takes its toll on the profitability of the overall organization.

Even this argument, however, does not change the significance of the marginal profitability analysis. If we can add “value” without adding more overhead, shouldn’t we do that?

When evaluating the overall profitability of the bank, the investment portfolio can still have a significant impact on the bottom line of the organization, even when rates are relatively low.

We hope you found this Pro Shop helpful. Please contact us if you have any questions regarding this topic or any of the products and services we provide.

Thank you for your continued confidence and for your business.